Since our founding in 1912, Conning has been focused on meeting the needs of the insurance industry. Our deep understanding of the issues facing insurers and our distinct perspective allows us to create customized investment solutions that can improve our clients’ financial results.

Insurers: Request a

Free Peer Analysis

Free Peer Analysis

An Investment Approach Focused on the Needs of Insurers

Click Below to Learn More

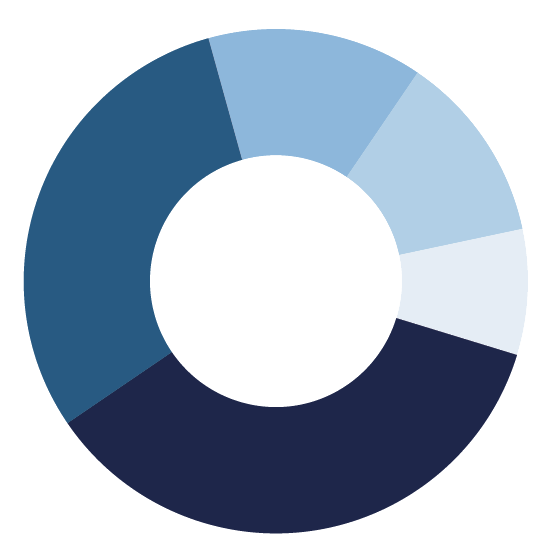

Assets by Client Type as of June 30, 20191 (US$ Millions)

$145,464

- $52,021 Life & Health Insurers

- $43,942 Property Casualty Insurers

- $20,094 Other2

- $17,298 Retail3

- $11,709 Pension

1. As of June 30, 2019, represents the combined global assets under management for the affiliated firms under Conning Holdings Limited, Cathay Securities Investment Trust Co., Ltd. (“SITE”) and Global Evolution Fondsmæglerselskab A/S and its group of companies (the “Global Evolution Companies”). The Global Evolution Companies are affiliates of Conning. SITE reports internally into Conning Asia Pacific Limited, but is a separate legal entity under Cathay Financial Holding Co., Ltd. which is the ultimate controlling parent of all Conning controlled entities.

2. Includes Asset Managers, Banks, Corporations, Foundations, Family Offices, Fund of Funds, Sovereign Wealth Funds, Sub-advised /Third-party Funds, Trusts, and other investors.

3. Retail Funds including Emerging Markets Public Funds, CLO Funds and SITE Mutual Funds.

2. Includes Asset Managers, Banks, Corporations, Foundations, Family Offices, Fund of Funds, Sovereign Wealth Funds, Sub-advised /Third-party Funds, Trusts, and other investors.

3. Retail Funds including Emerging Markets Public Funds, CLO Funds and SITE Mutual Funds.

Investment

Management

Management

Insurance

Expertise

Expertise

Liability-Driven

Investing

Investing

Client Services

& Reporting

& Reporting

Strategic Asset

Allocation

Allocation

The Conning Advantage

Benchmark your firm's financial and investment strategy to see how you compare to peers.